34+ Debt to income ratio to buy a home

Debt to income ratio is the amount of money owed debt versus the amount of money made income in any given month. RFirstTimeHomeBuying First Time Home Buyer Down Payment Assistance.

Hard Money Private Money Sun Pacific Mortgage Real Estate Hard Money Loans In California

Lock Rates For 90 Days While You Research.

. Your total debt cant exceed 43 of your total gross income. When you divide the monthly payments by the gross monthly income the result you get will be a decimal. Lenders prefer to see a debt-to-income ratio.

If you apply for a conventional home loan your ideal DTI ratio should be 36 or less. Were Americas Largest Mortgage Lender. Check Your Official Eligibility Today.

Should you buy a house if you have debt. Ad Updated FHA Loan Requirements for 2022. We Are Here To Help You.

Calculate Maximum Second Home Purchase Price Down payment on. Get Instantly Matched With Your Ideal Home Loan Lender. Check Your Official Eligibility Today.

Christa Rodriguez II Last update. The debt-to-income ratio will be displayed as a percentage. Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Ad Opendoor will handle everything for you from offer to closing. To get the back-end ratio add up your other debts along with your housing expenses. Dividing their total monthly debt by their income and multiplying that by 100 create a debt-to-income ratio of 40a risky bet.

For example if your total monthly debts. Answer Simple Questions See Personalized Results with our VA Loan Calculator. To qualify for a USDA loan your backend DTI should be 41 or less with no more than 29 of your income going toward your future.

To calculate your personal debt-to-income ratio you will divide your monthly debt owed by your monthly income. Debt-to-income ratio for a USDA loan. 465 59 votes Yes it is absolutely possible to buy a.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Dont Settle Save By Choosing The Lowest Rate. Take the First Step Towards Your Dream Home See If You Qualify.

Ad Purchasing A House Is A Financial And Emotional Commitment. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. You divide 2375 by 10500 which sets out to.

Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. FHA-backed loans require that your total housing debt must be 31 or less of your gross income. Take the First Step Towards Your Dream Home See If You Qualify.

Calculate the debt-to-income ratio by dividing the 2000 monthly debt payments by the 6000 total gross income to arrive at a debt-to-income ratio of 33. Calculate your DTI by dividing your total monthly debt payments by your total monthly gross income your income before taxes. Submit your address to get a free instant offer on your home from Opendoor.

Calculate Your Monthly Loan Payment. This is because your debt to income ratio exceeds the maximum recommended ratio of 43. RFirstTimeHomeBuying FHA 203k Rehab Loan - Include repairs in your mortgage.

Apply Now With Quicken Loans. Lock Your Mortgage Rate Today. Home buyers with higher debt to income ratios.

More posts you may like. Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. For instance if your monthly debt is 2000 and your monthly income is.

Debt to Income Ratio Defined. But if their debt dropped by 600 a month their. Then divide that by 6000 his gross monthly income.

Ad Updated FHA Loan Requirements for 2022. See If Youre Eligible for a 0 Down Payment. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

A good debt-to-income ratio to buy a house depends on your mortgage program. What is As DTI. 500 500 1000 and thatll yield a total of 2000.

Eliminating a 25000 monthly automobile payment will get you an extra 7000000 worth of housing buying power. Your front-end or household ratio would be 1800 7000 026 or 26. You add up all of As monthly debt payments.

Debt to income ratio is. Ad Compare Mortgage Options Calculate Payments. On the other hand if youre.

Compare Now Find The Lowest Rate. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Say for instance you pay.

Get your free offer today.

Bad Credit Home Loans How To Buy A House With A Low Credit Score

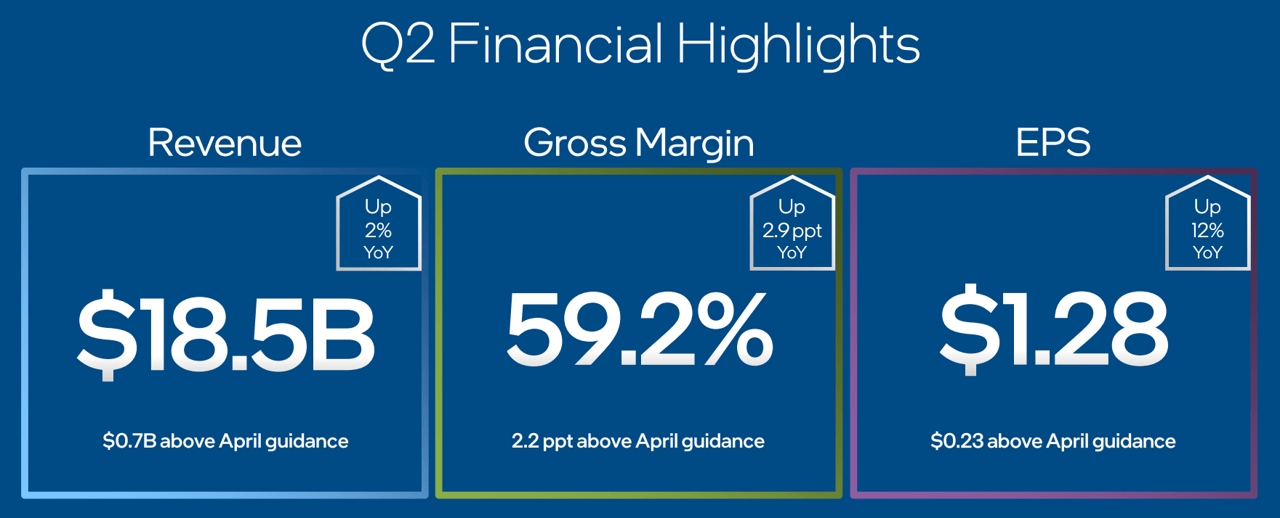

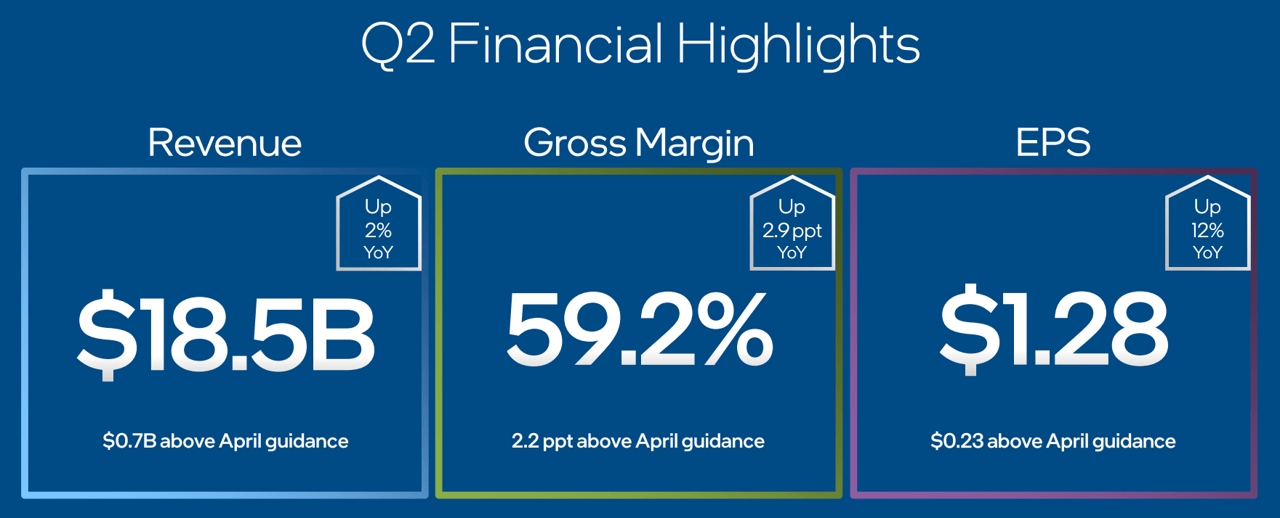

Intel Is Ugly Q2 2021 Earnings 3 Better Chip Stocks To Own Nasdaq Intc Seeking Alpha

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

15 Debt Payoff Planner Apps Tools Get Out Of Debt Debt To Income Ratio Home Improvement Loans Managing Finances

Just Because You Hear Something Does Not Mean It S True There Are Myths And Then There Are Facts Mortgag Home Buying Debt To Income Ratio Mortgage Rates

Bad Credit Home Loans How To Buy A House With A Low Credit Score

What Is A Unicap Calculation Quora

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Income

Bad Credit Home Loans How To Buy A House With A Low Credit Score

Debt To Income Ratio Debt To Income Ratio Home Buying Process Real Estate Information

Tuesday Tip How To Calculate Your Debt To Income Ratio

Bad Credit Home Loans How To Buy A House With A Low Credit Score

Stagwell Inc Nasdaq Stgw Reports Results For The Three And Six Months Ended June 30 2022

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt

Bad Credit Home Loans How To Buy A House With A Low Credit Score